The Case of Gucci's Digital Overexposure

- Juliette Chloe' Trifiro'

- Oct 29, 2025

- 15 min read

Updated: Nov 16, 2025

Years of digital overexposure have decreased Gucci’s desirability and financial value; however, is the new Demna era going to revitalize the brand or break it further?

Note from author: this is more of a long read, but definitely worth it!

Accessibility vs Exclusivity

Luxury brands offer tangible and intangible value; both are key for long-term brand equity (Kapferer, 2012). Accessibility in a luxury context refers to how easily consumers can purchase the good, from a cultural, physical, and financial perspective. Exclusivity enhances the desirability of a product by intensifying consumers’ aspirations to embody the qualities associated with a luxury brand. In doing so, it becomes a means for individuals to elevate their self-image and social status (De Barnier, Falcy, & Valette-Florence, 2012).

Marketing to aspirational consumers is key for long-term growth, as they account for 60% of the luxury goods market and spend €2,000 or less per year (D’Arpizio et al., 2025). Brands need to nurture these potential customers by educating and elevating their brand hierarchy and likelihood of purchase, through engagement, storytelling and brand experiences (D’Auria et al., 2024). In fact, Kapferer (2012) suggests that marketing based on aspiration and the brand’s intangible value, not only increases brand equity, but also encourages customers to attach themselves to the brand and its prestige. In practical terms, this means switching away from marketing scarcity to marketing “abundant rarity”.

To an extent, the balance between accessibility and exclusivity is never fully achieved, but it is not mutually exclusive (Tandon, 2025). The key is to be accessible through digital channels and product segmentation, which sustains brand desirability and loyalty. In fact, the main purpose of social media is to engage with potential long-term buyers. However, if the brand is overexposed, it can lead to the dilution of the brand's core values (Ibid). Overexposure and improper product positioning are caused by brands favouring accessibility rather than exclusivity, thus resulting in luxury brands becoming masstige brands. This phenomenon quoted by Rodrigues and Borges (2020), is the ‘democratisation of luxury brands’, which sees brands such as Gucci mass-marketed to favour profitability, leading to their marker of prestige and scarcity being diluted and, in some cases, lost.

Consequently, marketing in the digital era still needs to use traditional luxury markers (heritage, scarcity, and price). Marketing based on heritage is one of the strongest strategies for luxury brands to follow, as heritage can reinforce and build an emotional connection and increase the customer's willingness to accept higher prices (Wiedmann et al., 2012). Marketing centres on communicating the brand’s origin and craftsmanship through storytelling supported by visual and symbolic cues that reinforce tradition (Siu, 2025). Using scarcity in after sales marketing provokes social signalling and increases the brand's perceived value and thus its exclusivity, for instance, the infamous Birkin (Olga Nechaeva et al., 2024). Finally, price is a strategic marker for luxury brands, as it signals prestige and superior quality, causing customer loyalty and boosting brand equity (Raut et al., 2025). Whilst price is set to cut out customers, paradoxically customers have a positive perception of high prices, associating it with higher satisfaction and a sign of luxury (Parguel, Delécolle and Valette-Florence, 2015).

Research Methodology

Secondary research and social listening tools such as YouTube, Financial Times, Reddit, and LinkedIn comments will be used to explore the case. Whilst a metadata analysis is required to determine whether the marketing strategy or other internal and external factors caused the downturn, using public data, such as financial statements and social media metrics, is useful for understanding public sentiment and purchase behaviour. OpenAI (2025) ChatGPT has been used to graph models and assumptions. ChatGPT has been proven useful in bypassing paywalls and thus being able to construct previous years' media metrics.

Gucci’s Current Situation

Gucci’s financial performance in Q2 2025 saw a 25% decline in sales mainly driven by reduced demand in the Asia-Pacific region and tourism-dependent markets (Guilbault, 2025). Gucci’s expansion and the resulting market saturation may have diminished the brand’s exclusivity, making it less resilient to macro headwinds (Ibid). Further trends such as 'quiet luxury' have decreased demand for conspicuous brands like Gucci. The luxury market has seen a decrease in small leather goods sales and an increase in designer jewellery (Felsted, 2025). To some extent, external factors have caused the downturn in sales and revenue; however, the following analysis will examine how Gucci's digital marketing strategies have decreased Gucci's desirability.

Pinault, Kering’s CEO, Gucci’s parent company, shares: “we have grown … Gucci, by leveraging their core element of desirability. That has meant relying largely on the aspirational part of the market. So now, while protecting this customer segment…we aim at better penetrating more elevated clientele” (WARC, 2025). What is the actual customer sentiment?

From a brand equity perspective, Gucci held a leadership position during its peak from 2018 and 2022. However, due to internal decisions and a shift in luxury trends, Gucci lost its brand stature, indicating a shift to an unrealised position, as shown in Graph I. Brand strength remains high because of Gucci’s history and high budget on influencer marketing.

Graph I: Gucci’s Brand Asset Valuator from 2018 to 2025

Gucci’s Current Marketing Strategy

As G-Co Agency (2024) discloses, Gucci’s marketing budget in 2024 was roughly $567 million, around 11% of Gucci’s revenue. Gucci heavily invests in engaging content that is relevant to the consumer, encouraging them to purchase; in fact, ¼ of the budget goes directly to advertising spend (Mediaradar, no date). More than a half of Gucci's marketing budget is split into celebrity/influencer-related costs, AI customer analysis and distribution of the relevant marketing assets, to reach its digital-savvy customers through its “social-first advertising strategy” (Pulse Advertising, 2025). This strategy has worked in the past, as 50% of its customers are Millennials and Gen Z (Ibid).

Most of Gucci’s followers are aspirational consumers who engage with the brand for cultural relevance rather than immediate purchases, which is common with luxury brands, as these consumers connect with brands through iconic campaigns rather than transactional intent (McKinsey & Company, 2022). Gucci’s feed features high-impact visuals, celebrity endorsements, and fashion show coverage. Table II demonstrates Gucci’s vast digital accessibility, appealing to a broad consumer base. Based on industry benchmarks, roughly 260,000 to 780,000 people are likely to be near-term purchasers within the next 12 months (Hootsuite, 2024), implying that up to 96.5% of its followers are aspirational followers.

Table II: Distribution of Gucci’s Instagram followers

Followers | Near-term purchasers (within 12 months) | % Near-term purchasers | Aspirational / passive followers | % Aspirational |

51,900,000 | 260,000 – 780,000 | 0.5 – 1.5% | 47,600,000 – 50,200,000 | 91.5 – 96.5% |

In terms of brand equity, its followers demonstrate high levels of brand awareness as it's one of the most followed luxury brands on Instagram. However, its actual content shows a brand that is struggling to engage its customers. As content does not revolve around scarcity or heritage, the focus is brand esteem rather than relevance or differentiation. With OpenAI’s (2025) ChatGPT expertise, Instagram’s following, engagement and revenue have been mapped out in relative terms, as shown in Graph II.

Graph II: Mapping Revenue, Instagram following and engagement

Graph II shows followers rose steadily from 2019 to 2024 (+66.6%), reflecting sustained digital reach growth (HypeAuditor, 2025). Revenue was more volatile, declining to 79.4% by 2024 (Guilbault, 2025). Social engagement declined 67% by 2024, indicating lower interaction per follower despite overall audience expansion. The trend suggests follower growth did not translate proportionally into either engagement or revenue. Instead, low engagement similarly reflects Gucci’s revenue downturn, which might imply Gucci’s loss in relevance.

TikTok

Gucci embraced TikTok early on and has mastered the exclusive Italian slow-living summer aesthetic in its videos, fostering aspirational desirability with its digital-savvy audience, as seen in Figure I.

Figure I: Gucci’s latest TikTok videos

Nevertheless, engagement remains low by TikTok standards, 0.62%, compared to its 2% benchmark (HypeAuditor, 2025). This may be because Gucci is mixing its core values across platforms rather than adapting its message to each platform. People do not associate posts that use heritage and “abundant rarity” with Gucci; they associate Gucci with its viral challenges and its playful manner. Gucci embraced TikTok early on. In 2020, the #GucciModelChallenge sparked organic brand advocacy by celebrating the distinctive aesthetic that many associated with Gucci, resulting in a surge in brand stature. However, this differentiation was closely tied to then–creative director Alessandro Michele and his signature quirky style. As a result, Gucci’s brand stature became vulnerable, as its distinctiveness was anchored more to the designer than to the brand itself.

Roblox

Gucci has been trying to raise its relevance with its digital-savvy audience by partnering with Roblox, a gaming platform where Gen Z ‘hangs out’. From 2021 to 2023, it launched a series of immersive virtual experiences where gamers where able to buy digital fashion items ranging from $8-$18. One of the campaigns garnered 20 million visits, of which 17% of gamers that purchased a digital item also bought a real item within 90 days, and 28% of gamers visited Gucci’s e-commerce site after engaging with the digital experience (Aryal, 2025). Although results indicated a successful campaign, associating themselves with Roblox reduced the brand's image, favouring short-term profitability to long-term brand equity, brand strength over brand stature, and accessibility over exclusivity.

Figure II Gucci Roblox Outfits

The Case of Gucci’s Digital Overexposure

The Accenture Brand Desirability Framework, cited in Standish, Benichou and Galante (2024), can be used to analyse Gucci’s desirability, which will help identify whether Gucci’s digital exposure impacted its exclusivity image. Table III tracks customer sentiment online; it’s quite clear that customers do not view Gucci as a luxurious brand.

Table III: Applying the Accenture Brand Desirability Framework, cited in Standish, Benichou and Galante (2024) to Gucci

Brand Desirability Pillars | Quotes |

Exclusivity | “In Germany Gucci started sponsoring a lot of trashy rappers somewhen in the mid 2010s. The rappers’ primary audiences then resorted to buy a lot of Gucci fakes. Nowadays you see mostly people with migrant background and low socio-economic resources sporting Gucci. That lead to a poor perception and reputation of the brand, being associated with “low class” and fake products” (@Mondscheinstaub, 2925) “Brand that replaced luxury and extravagant with "the name on the label is enough", bye bye”( Richard C., 2025). |

Quality and Craftmanship | “Yes, Gucci is real luxury, but its marketing isn't working that well anymore.” (Elpidoforo, 2025)

“I rather spent my money on older or vintage pieces because the quality was much better” (u/stephanielikesbags, 2025) |

Heritage | “I love Gucci and the history of the brand. I still have a Gucci coat by tom ford and it’s still looking immaculate. The current prices reached my limit. This is just my opinion. I will not spoil myself for a new Gucci bag which costs 2000 euro and more. There are similar vintage versions. Which costs 300 euro. I am happy with that.” (u/stephanielikesbags, 2025) |

Social Value | n/a |

Experience | “I’ve purchased a lot of Gucci over the years and truly enjoyed their boutique experiences over some of the other brands” (u/lifecrisisonrepeat, 2025) |

Innovation | According to Vogue Business (2024) Gucci retains innovation leadership |

Iconic Status | “There is a saturation of luxury, everyone got their bags, people are moving on, the brands focused too much on aspirational customers and those aspirations have changed whether its saving for a house or getting out of debt. They shouldn't have expanded too fast if they didn't want to alienate the loyal luxury long term consumer.” (@ShortyFY1304, 2025) |

The emerging public sentiment is, for the most part, negative. What sticks out are sentiments of boredom and disinterest. Years of exposure have depleted Gucci’s brand image. Gucci has mass-marketed its brand and products to the extent that high-net-worth buyers do not want to be associated with the brand, meaning that Pinault’s strategy is going to require major internal operational overturns. Remarkably even people who recognise its heritage value, would not buy the brand today, preferring vintage pieces that not only hold aspirational value but also refer to a time when Gucci’s perception was of luxury. Gucci should leverage its history and past to recoup these customers. One customer says it better: “Gucci’s future hinges on a delicate balance: honouring its rich design heritage while making itself culturally vital again” (Tong, 2025).

Clearly, Gucci missed the mark; it became too abundant without making itself rare. Its previous marketing strategy of attracting digital-savvy customers by meeting them at each touchpoint made the brand too accessible without retaining exclusivity, which, even during times of economic uncertainty and high purchasing power, decreased Gucci’s overall desirability. Targeting Millennials and Gen Z was a strategy that preferred short-term profitability over long-term hierarchy growth as this audience tends to buy mostly entry products (Eastman et al., 2010), substantially below the €2,000 threshold, thus requiring Gucci to constantly acquire new customers whilst also trying to build customer rapport. The Roblox initiative raised Gucci’s awareness with the younger generation, but it did not necessarily translate into future purchases.

They have targeted customers at the low end of the aspirational spectrum and with increasing prices each year, they have out priced their aspirational customers, as seen in Table IV. Without marketing based on heritage or scarcity signalling, Gucci lost its leadership position. As such, Gucci cannot impose a price premium strategy any longer and they can’t reduce prices either, as that would further decrease Gucci’s value.

Table IV: Customers perception on price

“Gucci needs to bring the prices down a notch. They CANNOT keep trying to compete with the likes of Louis Vuitton, Prada, or Chanel. They sold a ton of shoes, accessories, jewelry, small leather goods, and even RTW under Michele when the prices were just a tiny bit less outrageous” (@zambowman,2025) |

“They need to drop the prices. Gucci was always somewhat affordable. I mostly buy ready to wear but the prices I can’t justify right now you’re not getting enough for your money.” (@onyxrhodetahuri,2025) |

“Their pricing greed over the last few years was totally out of control and clearly highlights they don’t realtor that their core customer base is predominantly “middle-class” professionals.. who have been priced out but also most people are not interested in buying BIG Label” (FT comment, 2025) |

What has made LVMH’s strategy so successful compared with Kering, specifically Gucci, is its ability to translate its core value across different platforms, engaging different audiences while keeping the message relevant. The core values of LVMH's brands remain the traditional luxury markers such as heritage, scarcity and price. Thus, LVMH will always be able to move along the BAV graph, as they have innate ability to balance accessibility and exclusivity.

If Gucci wants to target a high-end customer base, they will have to enact a companywide strategy. From a strategic marketing perspective, the main priorities are to rebalance exclusivity and accessibility and change customer perception. Gucci will have to simultaneously leverage its 100-year heritage with high level digital campaigns and create physical scarcity to signal status, value and quality. Is Demna the right person to do this?

Demna’s Gucci

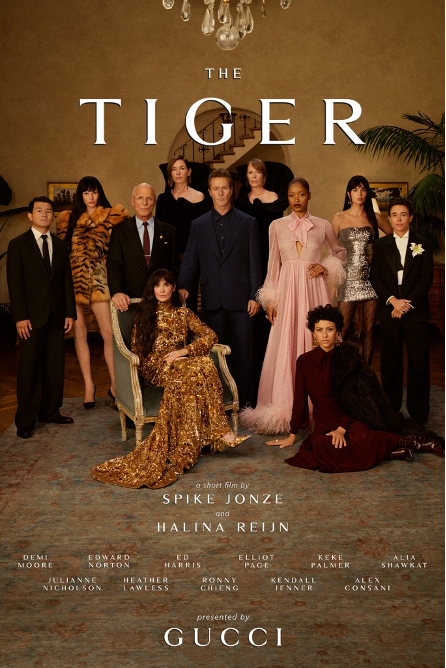

In September 2025 Gucci forwent the traditional catwalk with a campaign aimed at increasing brand relevance, and to a small degree, differentiation. Demna decided to create designs based on Gucci's brand archetypes, targeting its diverse customer demographic.

Figure III The Tiger short film cover

The Tiger, a short film directed by Oscar winning Spike Jonze, was incredibly well received from the fashion world. In practical terms, Launchmetrics has calculated “the value of Gucci’s mentions … [which] was $14 million” (Felsted, 2025). However, Google Trends worldwide searches for “Gucci” (Figure IV) reveal that the campaign did not increase overall brand relevance.

Figure IV: Online Interest for Gucci

Whilst the term “Demna Gucci”, skyrocketed at the time of the launch (Figure V) the campaign was credited with increased store traffic in the United States, after years of slow sales. Gucci’s New York store traffic was up 19% and in Los Angeles up 53% (Hummel and Spencer, 2025).

Figure V: Online Interest for Demna Gucci

Overall, Demna’s collection was a step in the right direction, as it vitalised Gucci’s brand relevance. Nevertheless, is it enough to turn around its financial performance? And what about the never-ending balance between accessibility and exclusivity?

Sure, the campaign boosted store traffic, but there is no way to know whether these potential customers were new or old customers. Reacquiring old customers would signify an increase in brand stature and thus a slow ascent to a leadership position. If only new customers showed up that could signify an increase in accessibility rather than exclusivity. If little to no sales occurred during this period, Gucci missed the mark, proving that Gucci has not mastered the balance between accessibility and exclusivity.

Overall revenue for Q3 was -18%, a slight improvement to Q2, in fact sales have "increased" from -25% in Q2 to -14% in Q3 (Kering, 2025). Demna's influence is only going to be seen in Q4 and Q1 of 2026; however whilst we await the verdict, some questions remain paramount:

What will happen when Demna eventually leaves Gucci? Will the cycle ever end? Essentially, how can luxury brands foolproof themselves from fashion designers and external trends?

In the meantime, I can only offer some suggestions to Gucci's marketing team.

Gucci should focus on heritage revival by showcasing its craftsmanship and iconic design moments through curated campaigns, reinforcing exclusivity and authenticity. Through platform-specific storytelling, Gucci can refine its digital image, using Instagram for aspirational visuals, such as past images of Grace Kelly wearing Gucci, and TikTok for brand-relevant creativity. Using selective ways to release information will restore prestige by limiting mass-market associations. With invite-only teasers, Gucci can reintroduce mystery and spark intrigue. These marketing tactics can shift customer perception from overexposed to once again aspirational and regain trust and relevance from high-value clients.

To reach high-end customers at their preferred touchpoints, Gucci should invest in curated cultural salons, adapting Prada’s model to reflect Gucci’s heritage and unique style. Each event could gather a mix of opinion speakers in the field of art and music, where they discuss themes that surround Gucci’s heritage, such as Italian craftsmanship or its archival design, while introducing contemporary cultural collaborations. By limiting attendance to high-value clients and influential tastemakers, Gucci reinforces exclusivity, fosters authentic connections, and gains high-end editorial coverage. With the same tone and objective, Gucci should sponsor high-end sporting events, such as St. Moritz Winter Polo or Longines Cup, due to Gucci’s heritage in the equestrian world.

For tasteful virality, Gucci can partner with Vogue to create a 10-part series shared via podcast and YouTube about Gucci’s history, fun facts and reviews of past collections. With the release of The Devil Wear Prada 2, Meryl Streep, leveraging her icon status, could host these videos. This partnership would create engaging content that educates and entertains, which will reintroduce Gucci’s heritage and creativity to a global audience.

Sources:

Aryal, A. (2025) 'Gucci Marketing Strategy Crisis-to-Comeback (2025),' Blankboard Originals, 14 April. https://www.blankboard.studio/originals/blog/gucci-marketing-strategy-crisis-to-comeback.

Ballina, J.F. and De La Ballina, I. (2019) 'scarcity as a Desirable Attribute of Luxury Fashion Brands in Millennial Marketing,' Market-Tržište, 31(2), pp. 153–170. https://doi.org/10.22598/mt/2019.31.2.153.

D’Arpizio, C. et al. (2025) Luxury in transition: Securing future growth. https://www.bain.com/insights/luxury-in-transition-securing-future-growth/

D’Auria, G. et al. (2024) Why courting aspirational luxury consumers still matters. https://www.mckinsey.com/industries/retail/our-insights/Why-courting-aspirational-luxury-consumers-still-matters#/.

De Barnier, V., Falcy, S. and Valette-Florence, P. (2012) 'Do consumers perceive three levels of luxury? A comparison of accessible, intermediate and inaccessible luxury brands,' Journal of Brand Management, 19(7), pp. 623–636. https://doi.org/10.1057/bm.2012.11.

De Boissieu, E. and Chaney, D. (2024) 'Defining brand heritage experience in luxury brand museums,' Qualitative Market Research an International Journal, 27(5), pp. 941–965. https://doi.org/10.1108/qmr-01-2024-0015

Eastman, J.K., Shin, H. and Ruhland, K. (2019). The Picture Of Luxury: A Comprehensive Examination Of College Student Consumers’ Relationship With Luxury Brands. Psychology & Marketing, 37(1), pp.56–73.

Exclusible (2024) GUCCI x Roblox Case Study - Exclusible. https://www.exclusible.com/resources/gucci-x-roblox-case-study/.

Felsted, A. (2025) 'Demna takes a Gucci-Loafered step in the right direction,' Bloomberg.com, 26 September. https://www.bloomberg.com/opinion/articles/2025-09-26/demna-takes-a-gucci-loafered-step-in-the-right-direction.

G-CO.Agency (2024) Gucci Digital Marketing, Advertising & Strategy Case Study | G & Co. https://www.g-co.agency/insights/gucci-advertising-strategy-case-study#scroll.

GUCCI (@gucci) • Instagram photos and videos (2025). https://www.instagram.com/gucci/.

Guilbault, L. (2025) 'Gucci sales fall 25% in Q2,' Vogue Business, 29 July. https://www.voguebusiness.com/story/companies/gucci-sales-fall-25-in-q2.

Hummel, T. and Spencer, M. (2025) 'Gucci’s fast-track approach for Demna’s fashions shows early signs of success,' Reuters, 6 October. https://www.reuters.com/world/china/guccis-fast-track-approach-demnas-fashions-shows-early-signs-success-2025-10-06/.

HypeAuditor (2025) Gucci (@gucci) TikTok Stats, Analytics, Net Worth and Earnings – HypeAuditor. https://hypeauditor.com/tiktok/gucci/?utm_source=chatgpt.com.

Kapferer, J.-N. (2012) 'Abundant rarity: The key to luxury growth,' Business Horizons, 55(5), pp. 453–462. https://doi.org/10.1016/j.bushor.2012.04.002.

Kering (2025) 'Revenue for the third quarter of 2025,' Kering, 22 October. https://www.kering.com/en/news/revenue-for-the-third-quarter-of-2025/.

McKinsey & Company (2022) The state of fashion: Luxury redefined. Available at: https://www.mckinsey.com/industries/retail/our-insights/the-state-of-fashion-luxury (Accessed: 12 August 2025).

OpenAI (2025) ChatGPT (version GPT-5) [Computer program]. Available at: https://chat.openai.com/ (Accessed: 15 August 2025).

Pulse Advertising (2025) Luxury Fashion 2025 - Pulse Advertising. https://www.pulse-advertising.com/influencer-marketing-resources/industry-reports/luxury-fashion-2025/.

Richard C. (2025, Apr 23) Comment on “Gucci sales sink as recovery stalls” [LinkedIn comment], LinkedIn. Available at: https://www.linkedin.com/news/story/gucci-sales-sink-as-recovery-stalls-6380748/?utm_source=chatgpt.com (Accessed: 15 August 2025).

Rodrigues, P. and Borges, A.P. (2020). Building Consumer-Brand Relationship In Luxury Brand Management. IGI Global.

Shepherd, J. (2025) Luxury brand Social Media Marketing. https://thesocialshepherd.com/blog/social-media-luxury-brands (Accessed: August 14, 2025).

Standish, J., Benichou, A. and Galante, A. (2024) Luxe Eternal: How luxury brands are reinventing for success, Accenture.com. https://www.accenture.com/content/dam/accenture/final/accenture-com/document-3/Accenture-Luxe-Eternal-Luxury-Report-1.pdf (Accessed: August 14, 2025).

Tam, F.Y. and Lung, J. (2024) 'Digital marketing strategies for luxury fashion brands: A systematic literature review,' International Journal of Information Management Data Insights, 5(1), p. 100309. https://doi.org/10.1016/j.jjimei.2024.100309.

Tandon, V. (2025) 'Luxury vs mass Appeal: How brands balance exclusivity and accessibility in Delhi NCR,' International Journal of Research Publication and Reviews, 6(5).

Tong, R. (2025) Luxury – An Analysis of Gucci’s fall in Q1. https://www.aplf.com/2025/04/29/luxury-an-analysis-of-guccis-fall-in-q1/

Tracy, M. (2025) 'S&P Global revises credit outlook for Gucci owner Kering to negative from stable,' Reuters, 11 August. https://www.reuters.com/business/sp-global-revises-credit-outlook-gucci-owner-kering-negative-stable-2025-08-11/.

u/lifecrisisonrepeat (2025, [date of comment]) Comment on “Gucci Just Lost Me. Here’s Why” [Online comment], Reddit, r/handbags. Available at: https://www.reddit.com/r/handbags/comments/1juy8eq/gucci_just_lost_me_heres_why/ (Accessed: 15 August 2025).

u/stephanielikesbags (2025, 4 months ago) Comment on “Gucci Just Lost Me. Here’s Why” [Online comment], Reddit, r/handbags. Available at: https://www.reddit.com/r/handbags/comments/1juy8eq/gucci_just_lost_me_heres_why/ (Accessed: 15 August 2025).

u/stephanielikesbags (2025, 4 months ago) Comment on “Gucci Just Lost Me. Here’s Why” [Online comment], Reddit, r/handbags. Available at: https://www.reddit.com/r/handbags/comments/1juy8eq/gucci_just_lost_me_heres_why/ (Accessed: 15 August 2025).

Visibrain (2025) Managing the Image of a Luxury Group on Social Media – Interview with Clara Mallien, Visibrain, 6 February. [Online]. Available at: Visibrain blog (accessed 14 August 2025).

Vogue Business (2024) 'Gucci retains Index innovation leadership, but Hugo Boss and Versace surprise with virtual activations,' Vogue Business, 8 October. https://www.voguebusiness.com/story/technology/gucci-retains-index-leadership-but-hugo-boss-and-versace-surprise-with-virtual-activations.

WARC (2025) Kering remains confident in its strategy for Gucci | WARC | The Feed. https://www-warc-com.iclibezp1.cc.ic.ac.uk/content/feed/kering-remains-confident-in-its-strategy-for-gucci/10306

@Mondscheinstaub (2025) Comment on “Gucci In Serious Trouble As Revenue Drops (Kering 2024 Financial Report)” [YouTube comment], YouTube, uploaded by Fashion Roadman (2025). Available at: https://www.youtube.com/watch?v=r9alg78PmcM (Accessed: 15 August 2025).

@onyxrhodetahuri (2025) Comment on “Gucci’s Big Problem… and Demna’s Big Chance?” [YouTube comment], YouTube, uploaded by Mary’s Room (2025, [Video upload date]). Available at: https://www.youtube.com/watch?v=1jWrzIMJVCg (Accessed: 15 August 2025).

@RyzealSourcing (2025) Comment on “Gucci’s Big Problem… and Demna’s Big Chance?” [YouTube comment], YouTube, uploaded by Mary’s Room (2025, [Video upload date]). Available at: https://www.youtube.com/watch?v=1jWrzIMJVCg (Accessed: 15 August 2025).

@ShortyFY1304 (2025)Comment on “Gucci’s Big Problem… and Demna’s Big Chance?” [YouTube comment], YouTube, uploaded by Mary’s Room (2025, [Video upload date]). Available at: https://www.youtube.com/watch?v=1jWrzIMJVCg (Accessed: 15 August 2025).

@zambowman (2025) Comment on “Gucci’s Big Problem… and Demna’s Big Chance?” [YouTube comment], YouTube, uploaded by Mary’s Room (2025, [Video upload date]). Available at: https://www.youtube.com/watch?v=1jWrzIMJVCg (Accessed: 15 August 2025).

What a great read!